TaxJar Integration

Automatically calculate and report your taxes using TaxJar

One of the most common difficulties in quickly and accurately creating invoices and quotes is determining the taxes. Tax calculations will take into consideration the sender's nexus, product categorization and receivers location. We're delighted to leverage our partnership with TaxJar in order to automate these calculations for you.

How do the tax calculations work?

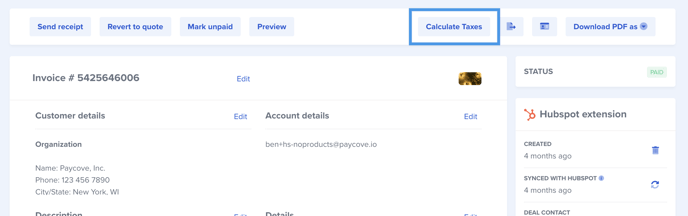

You can apply tax calculations to a quote or invoice in one of two ways. First, you may manually submit an invoice or quote to TaxJar for calculation. From the deal details page, you can click "calculate taxes" at any time.

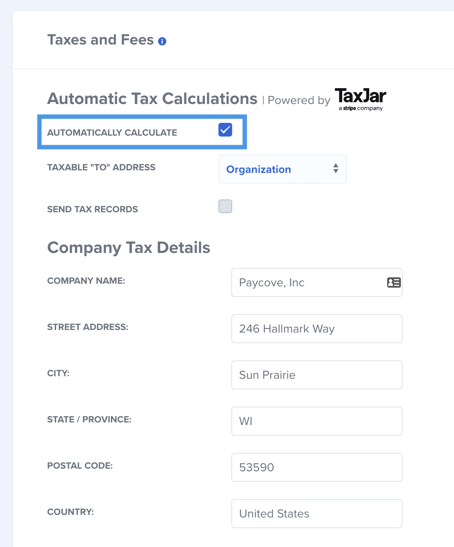

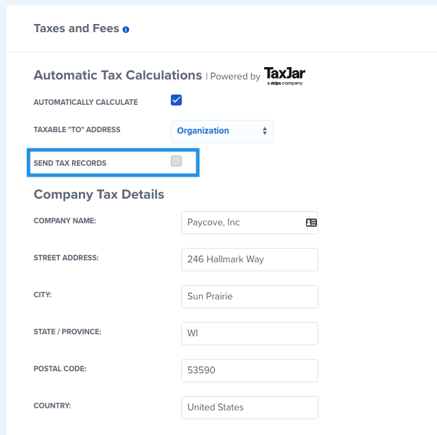

Second, you can configure Paycove to apply these tax calculations automatically. If enabled, Paycove will submit each invoice or quote for tax calculations as soon as it's created.

Either way the calculation is triggered, the calculation will take into consideration 3 things.

How are taxes calculated?

When submitting a quote or invoice for tax calculation, TaxJar considers 3 things:

1) From address or nexus. This address can be configured in your tax settings, or, if you have multiple nexuses on your TaxJar account, you can link your TaxJar account so that the calculations consider your multiple nexuses.

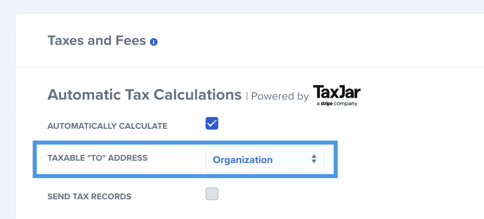

2) To address. This address is derived from one of two sources: the deal's contact (i.e. person, customer) or the organization (i.e. business, company). You may configure Paycove to pull the address from either source:

We use the following fields to compile the address for the calculation:

- country

- postal / zip code

- state

- city

- street / line1

3) Line Items and Product Categories. Some items sold by your company may be taxed a different rate than others. To account for this, you may associate each product with a tax category provided by TaxJar. To associate your product with a category, navigate to the products page and select the "Tax Category" from the dropdown.

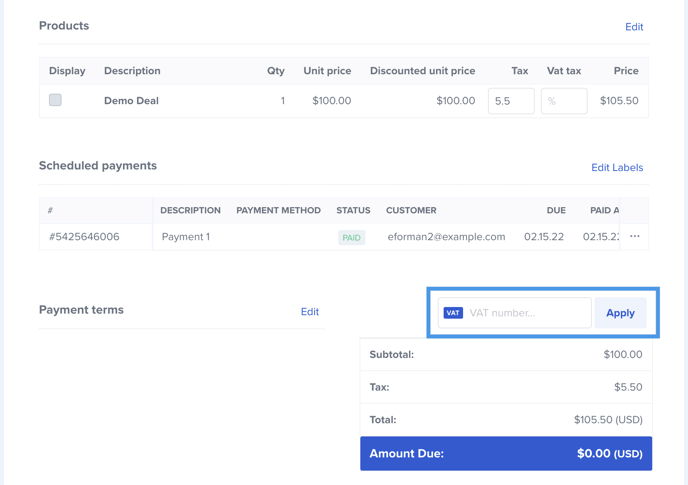

European calculations

You may also calculate taxes on invoices / quotes by comparing the to and from VAT numbers. The from VAT number is set in the tax settings field. The to VAT number may be set on each invoice or invoice. Either the Paycove user, or the end customer may enter their VAT number.

Rules for European Taxes

- If both to and from addresses contain a VAT number, apply these rules.

- If the to and from addresses both possess valid VAT numbers, and are from the same country, apply that country's standard tax rate, except for products denoted on the products table as 0% (i.e. tax exempt).

- If either to or from addresses do not possess valid VAT numbers, or are not from the same country, do not apply taxes.

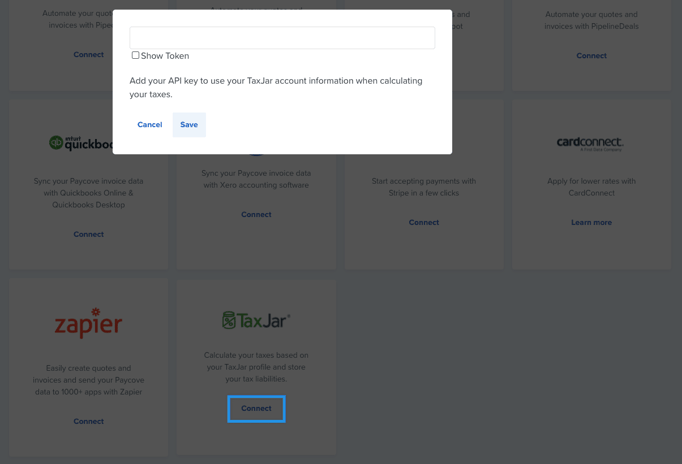

Connecting your TaxJar account

If you have a TaxJar account, and would like Paycove to use this account for tax calculations, and recording taxable transactions, you may connect TaxJar to Paycove by providing your API token on Paycove's integrations page.

Where do I find my TaxJar API token?

Once you provide your TaxJar API token, you may record transactions from Paycove, as well as calculate taxes using your TaxJar nexuses.

Recording Transactions in TaxJar

Similar to the tax calculations, you may also trigger a transaction record by configuring transactions to automatically record after a charge is made.

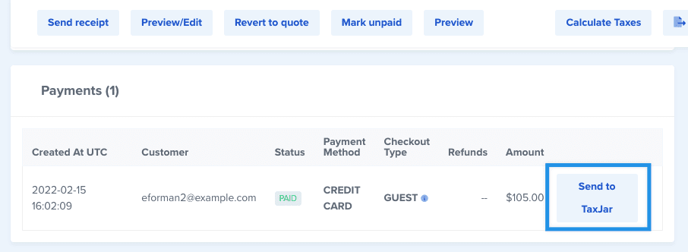

Alternatively, you may manually record a transaction from the invoice's charge table.